What method of payment do you accept?

We accept cash, checks, money order, Discover, Visa and MasterCard.

What is a Good Faith Estimate?

How can I pay my bill?

You can pay your bill online either through your patient portal account. For billing questions please call 866-905-4477 Monday through Friday 9:00am-5:00pm.

Why does my statement show a total account balance when I have insurance coverage?

If your insurance plan does not cover the services you received, you are financially responsible for your charges.

What happens if I cannot make the payment in full?

In most cases, we can help establish a payment plan depending on your balances due. Partial payments made toward your balance will not stop collection activity unless you have made payment arrangements with us. Please contact Patient Financial Services to discuss payment options at Tel: 866-905-4477

What happens if I see a mistake on my bill?

If you have billing questions, please contact Patient Financial Services at 866-905-4477 Monday through Friday 9:00am-5:00pm.

Why are my bills so high—I already paid my co-pay at the time of the visit?

Deductible and co-insurance requirements per your contract benefits may be the additional responsibility.

Why am I getting calls from a collection agency?

After a 120-day billing cycle, your balances may be transferred to an outside agency.

I called my insurance company and they said you have coded this wrong—can you re-code and re-bill it?

We can have your encounter reviewed by our coding department to determine if any other action is needed. Please contact Patient Financial Services at Tel: 866-905-4477

What does Assignment of Benefits mean?

Assignment of Benefits authorizes University Eye Center (UEC) to submit claims on my behalf to my insurance company, Medicare, or other third party payers for my care and authorize disclosure of health information to the extent necessary to obtain payment for the clinic services.

What is the difference between an eye exam and a refraction?

A refraction test is usually given as part of a routine eye examination. It may also be called a vision test. This test tells your eye doctor exactly what prescription you need in your glasses or contact lenses.

Is a refraction a covered service?

Some insurances but not all cover refraction. For example, Medicare does not cover refractions because they consider it part of a “routine” exam and Medicare does not cover most “routine” procedures – only health-related procedures.

When do I pay my co-pay, co-insurance, or deductible?

Your out-of-pocket responsibility is due when you register. If you are unsure of your financial liability, please refer to your insurance card or contact your insurance directly.

Do I need to bring my insurance card with me at the clinic?

Yes, it is very important that you bring your insurance card with you to ensure that we have accurate billing information to correctly file your claim and also specify if you have a vision plan. You will be asked to present your card and identification when you register.

Is a contact lens fitting and/or evaluation part of a routine examination?

Most insurance plans do not pay for this service. There may be a separate fee depending upon your individual insurance coverage.

Do I have to obtain a referral to be seen?

If your insurance plan requires a referral, you must obtain the referral prior to your appointment. Otherwise, you will be responsible for payment. If you are unsure if a referral is required, please refer to your insurance card or contact your insurance directly.

I made a payment, but I received another billing statement. Why?

The statement could have been sent prior to the posting of your payment, or you may have received a bill for a different service date.

Is there a fee for a returned check?

Yes, the fee for a returned check is $20.

What insurance plans do you accept?

We accept most Medicaid Medicare and most major medical and vision plans.

For a listing of our participating plans, please see link.

Does my medical insurance cover routine eye care?

Typically, major medical insurance or a managed care plans pay for procedures that are used to diagnose and treat eye disease. While the examination may provide you with a new eyeglass prescription, medical insurance rarely pays for routine care and refractions.

Is there a deposit required to process my order for materials (eyeglasses, contact lenses and/or low vision devices)?

Yes, a deposit of 50% of the charge for the materials is required in order to process your order.

Can I use my medical flex spending account to pay for my materials and/or visits?

Yes, you can use our medical flex spending account to pay for your materials (eyeglasses, contact lenses and/or low vision devices) and/or visits to the doctor. If your employer offers a medical flex spending account, contact your employer for more details.

Do you offer any financial assistance to the uninsured or underinsured?

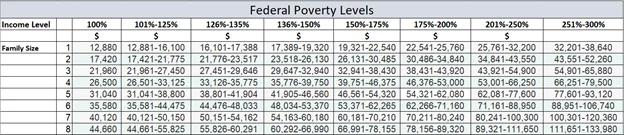

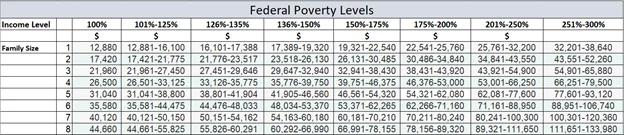

If you are uninsured or underinsured, you may qualify for a fee reduction based on specific financial eligibility. To apply for financial assistance, you will be asked to provide information, which includes financial income. We utilize the federal poverty levels as guide for fee reduction determinations. The federal poverty levels are listed below:

Please call 866-905-4477or email pfsfinapp@sunyopt.edu for information.

What is the difference between a routine eye examination and a visit for medically necessary care?

Vision care plans typically only cover routine vision examinations along with eyeglasses and contact lenses. Your visit for routine eye care allows your eye doctor to evaluate your visual needs. The doctor can determine if there is a need to prescribe or change your prescription for vision correction. It also allows him/her to evaluate your eye health, to rule out the most common eye diseases and to determine if there is a need for further visits. Vision plans do not cover diagnosis, management or treatment of eye diseases.

What is vision insurance and how does it differ from medical insurance?

Today it is relatively common to have a vision benefit plan in addition to your medical insurance. This can lead to confusion about whether your medical or vision insurance should be billed. Once the doctor concludes your examination and determines the billing code and depending on your insurance benefits your medical or vision plan could be billed. Vision insurance is usually a separate insurance in addition to your medical insurance that covers routine eye care which includes a refraction. Your vision plan may or may not include payments towards eyeglasses or contact lenses. Vision benefits cannot be used to treat medical problems. If you are unsure of your benefits, please contact your insurance directly.

Medical insurance is used to diagnose and treat diseases. Your medical insurance should be used if you have any eye problems or diseases. Medical eye care covers visits and procedures your doctor performs to diagnose and to treat eye disease, such as glaucoma, dry eye, conjunctivitis and cataracts. It may or may not include determination of your eyeglass prescription.

You should use your vision benefit plan when you are not experiencing any ocular problems and only want a wellness exam or when you want to check if you need new glasses or contact lenses. Be sure to let us know the purpose of your visit when you schedule your appointment to lessen the chance of confusion as to whether the vision plan or the medical plan is the appropriate billing choice for the visit. If you have both types of insurance plans it may be necessary for us to bill some services to one plan and one to the other. We will bill your insurance plan for services if we are a participating provider for that plan. We will try to obtain advanced authorization of your insurance benefits so we can tell you what is covered. If some fees are not paid by your plan, we will bill you for any unpaid deductibles, co-pays or non-covered services as allowed by your insurance contract.